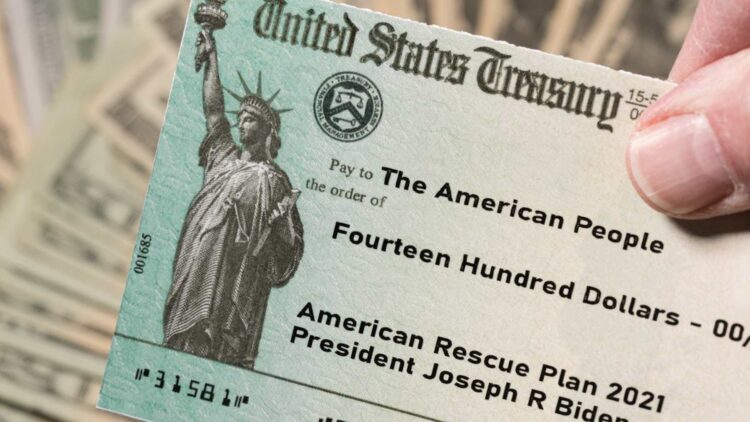

The COVID-19 pandemic brough on a lot of decisions made to help Americans stay afloat during trying times, and one of them were three stimulus checks meant to help those in need to have a little more income at a time when people were let go left and right. There were three payments in total made and one of them, made in 2021 for $1,400 can still be claimed for those who were eligible and failed to do so at the time.

Since these stimulus payments were claimed through taxes, this is the last year to claim the missing payment for 2021. This year Americans will be filing taxes for the year 2024 and taxes can be filed up to three years after they are originally due so this truly is the last time (in fact the last few days since taxes are due n April 15) to claim the missing money or it will be returned to the U.S Department of Treasury

The 2021 stimulus check claim

There is a surprising amount of people that were eligible for this payment and did not claim it, the most common reason being they chose not to file taxes that year due to not needing to do so. A tip from the Internal Revenue Service is to always file taxes even if you do not need to just in case some tax credits or refunds apply to your family, and you can get some of the money you paid back.

In order to get this payment you had to qualify. Some of the requirements are:

- Single filers had to earn no more than $75,000 in adjusted gross income (AGI). Heads of household had a higher limit at $112,500, and married couples filing jointly were eligible with a combined AGI up to $150,000. Those who earned more money could still qualify for some assistance but the payments were smaller. If a single filer earned more than $80,000, heads of household reached $120,000, or joint filers made $160,000, the payment disappeared completely.

- The filer had to have a valid Social Security Number. If a couple was filing jointly, both spouses had to have a valid number, otherwise they would have to file separately to qualify. Children or other dependents also had to have either a Social Security Number or an Adoption Taxpayer Identification Number (ATIN) to qualify for their portion of the payment.

- You also had to make sure no one else claimed you as a dependent on their 2021 tax return and that rule excluded many college students and adult dependents from getting their own checks. In those cases, whoever claimed them would receive the $1,400 on their behalf instead. Dependents played a big role in how much a household received, as each one who met the criteria added another $1,400 to the total as long as the family was under the income threshold. Even children born in 2021 or newly added dependents could bring in $1,400 each—but only if they were included on that year’s tax return. So if a baby was born during the year, the family could still get the payment, as long as they filed correctly.

Those who were eligible for the $1,400 stimulus payment in 2021 but did not receive it still have a chance to claim it through the 2021 Recovery Rebate Credit. You can do it either by filing or amending your 2021 tax return (amending it in case you filed wrong or had a change of address that prevented the check from reaching you at the time). If you believe that you could be one of those who should have received the money, now is your chance to do so before the deadline closes and the money is lost forever.